Chapter 5 Reconstitution of Partnership (Death of Partner) Textbook Exercise Questions and Answers.

1. Objective questions:

A. Select the most appropriate answer from the alternative given below and rewrite the sentences.

Question 1.

Benefit Ratio is the ratio in which _______________

(a) The old partner gain on the admission of a new partner

(b) The Goodwill of a new partner on admission is credited to old partners

(c) The continuing partners’ benefits on retirement or death of a partner

(d) All partners are benefitted.

Answer:

(c) The continuing partner’s benefits on retirement or death of a partner

Question 2.

The ratio by which existing partners are benefitted _______________

(a) gain ratio

(b) sacrifice ratio

(c) profit ratio

(d) capital ratio

Answer:

(a) gain ratio

Question 3.

Profit and Loss Suspense Account is shown in the new Balance Sheet on _______________ side.

(a) debit

(b) credit

(c) asset

(d) liabilities

Answer:

(c) asset

Question 4.

Death is a compulsory _______________

(a) Dissolution

(b) Admission

(c) Retirement

(d) Winding up

Answer:

(c) Retirement

Question 5.

The balance on the Capital Account of a partners, on his death is transferred to _______________ Account.

(a) Relatives

(b) Legal Heir’s Loan/Executors Loan

(c) Partners’ Capital

(d) Partners’ Loan

Answer:

(b) Legal Heir’s Loan/Executors Loan.

B. Write a word, term, phrase, which can substitute each of the following statements.

Question 1.

Excess of credit side over the debit side of Profit and Loss Adjustment Account.

Answer:

Profit

Question 2.

A person who represents the deceased partner on the death of the partner.

Answer:

Legal Heir’s or Executor

Question 3.

Accumulated past profit kept in the form of reserve.

Answer:

Reserve fund or General reserve

Question 4.

The partner who died.

Answer:

Deceased partner

Question 5.

The proportion in which the continuing partners benefit due to the death of a partner.

Answer:

Gain/Benefit ratio

C. State whether the following statements are True or False with reasons.

Question 1.

A deceased partner is not entitled to the Goodwill of the firm.

Answer:

This statement is False.

A deceased partner’s contribution was there in the development of business and goodwill is the value of the business in terms of money. Hence, a deceased partner is entitled to receive goodwill from the firm.

Question 2.

A deceased partner is entitled to his share of General Reserve.

Answer:

This statement is True.

General reserve is created out of past undistributed profit. Past profit is earned due to the efforts and hard work of all the partners including the partner who is now dead. Hence a deceased partner has right on it and therefore a deceased partner is entitled to receive his share of General reserve.

Question 3.

If goodwill is written off, a Deceased Partner’s Capital Account is debited.

Answer:

This statement is False.

When the benefits of goodwill are given to the deceased partner, his capital account is credited and when such goodwill is written off, capital accounts of remaining partners are debited.

Question 4.

After the death of a partner, the entire amount due to the deceased partner is paid to the legal representative of the deceased partner.

Answer:

This statement is True.

After the death of a partner, the entire amount due to the deceased partner is paid to the legal representative of the deceased partner as he is the only person who has the legal right to that amount.

Question 5.

For recording the profit or loss up to the death, the Profit and Loss Appropriation Account is operated.

Answer:

This statement is False.

For recording the profit or loss up to the death, the Profit and Loss suspense Account is created and operated. This is because final accounts cannot be prepared on the date of death of a partner. Till that period a separate account called Profit and Loss Suspense A/c is prepared.

D. Fill in the blanks and rewrite the following sentence.

Question 1.

Deceased Partners’ Executors Account is shown on the _______________ side of the Balance Sheet.

Answer:

Liabilities

Question 2.

On the death of a partner, a ratio in which the continuing partners get more share of profits in future is called as _______________ Ratio.

Answer:

Gain

Question 3.

Deceased partners share of profit up to the death is shown on _______________ side of Balance Sheet.

Answer:

Assets

Question 4.

Benefit Ratio = New Ratio – _______________

Answer:

Old Ratio

Question 5.

When Goodwill is raised at its full value and it is written off _______________ Account is to be credited.

Answer:

Goodwill

E. Answer in one sentence only.

Question 1.

What is Gain Ratio?

Answer:

The profit-sharing ratio which is acquired by the surviving or continuing partners on account of the death of any partner is called gain ratio or benefit ratio.

Question 2.

In which ratio general reserve is distributed on the death of a partner?

Answer:

General reserve is distributed on the death of a partner in their old profit sharing ratio.

Question 3.

To whom do you distribute general reserve on the death of a partner?

Answer:

On the death of a partner general reserve is distributed among all partners in their old profit and loss ratio.

Question 4.

How the death of a partner is a compulsory retirement?

Answer:

After the death of a partner, the business is not able to get any kind of services from the deceased partner and so we can say that the death of a partner is like a compulsory retirement.

Question 5.

To which account profit is to be transferred up to the date of his death?

Answer:

Profit of the deceased partner, up to the date of his death, is transferred to his Legal Heir’s/Executor’s Account.

Practical Problems

Question 1.

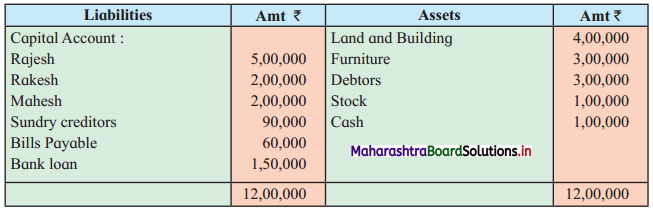

Rajesh, Rakesh, and Mahesh were equal Partners on 31st March 2019. Their Balance Sheet was as follows 31st March 2019.

Balance Sheet as of 31st March 2019

Mr. Rajesh died on 30th June 2019 and the following adjustment was agreed as:

1. Furniture was to be adjusted to its market price of ₹ 3,40,000.

2. Land and Building were to be depreciated by 10%.

3. Provide R.D.D. @ 5% on debtors.

4. The profit up to the date of death of Mr. Rajesh is to be calculated on the basis of last year’s profit which was ₹ 1,80,000.

Prepare:

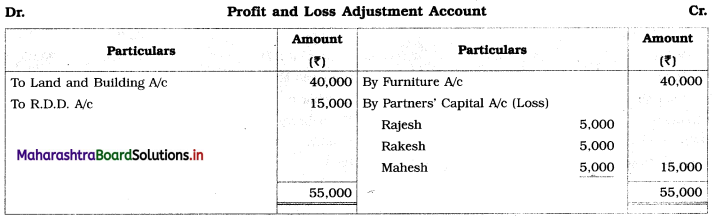

1. Profit and Loss Adjustment A/c

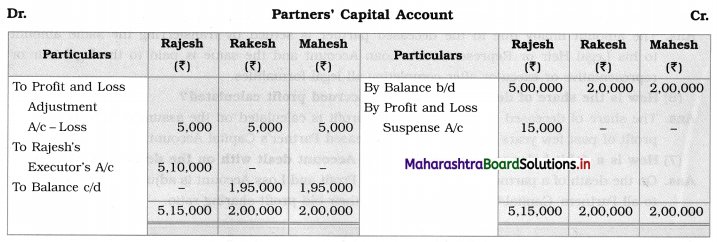

2. Partners’ Capital Account

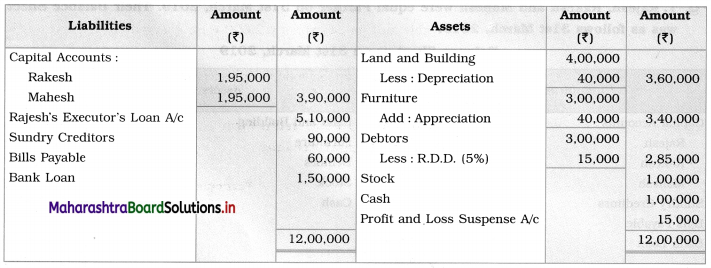

3. Balance Sheet of the continuing firm.

Solution:

In the books of the Partnership Firm

Balance Sheet as of 1st July 2019

Working Note:

The profit of the firm of last year was ₹ 1,80,000.

Proportionate profit up to the date of death for Rajesh is as follows

= 1,80,000 × \(\frac{3}{12} \times \frac{1}{3}\) (Period) (P & L ratio)

= ₹ 15,000 (Profit and Loss Suspense A/c)

Question 2.

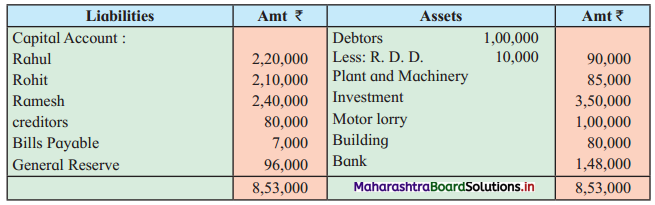

Rahul, Rohit, and Ramesh are in a business sharing profits and losses in the ratio of 3 : 2 : 1 respectively. Their Balance Sheet as of 31st March, 2017 was as follows:

Balance Sheet as of 31st March 2017

On 1st October 2017, Ramesh died and the Partnership deed provided that

1. R.D.D. was maintained at 5% on Debtors.

2. Plant and Machinery and Investment were valued at ₹ 80,000 and ₹ 4,10,000 respectively.

3. Of the creditors an item of ₹ 6,000 was no longer a liability and hence was properly adjusted.

4. Profit for 2017-18 was estimated at ₹ 1,20,000 and Ramesh’s share in it up to the date of his death was given to him.

5. Goodwill of the firm was valued at two times the average profit of the last five years, which were

2012-13 – ₹ 1,80,000

2013-14 – ₹ 2,00,000

2014-15 – ₹ 2,50,000

2015-16 – ₹ 1,50,000

2016-17 – ₹ 1,20,000

Ramesh’s share in it was to be given to him.

6. Salary ₹ 5,000 p.m. was payable to him.

7. Interest on capital at 5% i.e. was payable and on Drawings ₹ 2,000 were charged.

8. Drawings made by Ramesh up to September 2017 were ₹ 5,000 p.m.

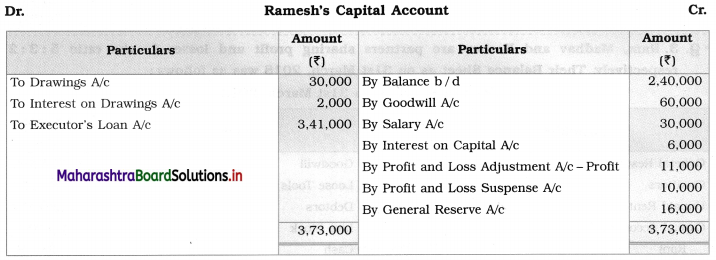

Prepare Ramesh’s Capital A/c showing the amount payable to his executors.

Give working of Profit and Goodwill.

Ramesh Capital Balance ₹ 3,41,000

Solution:

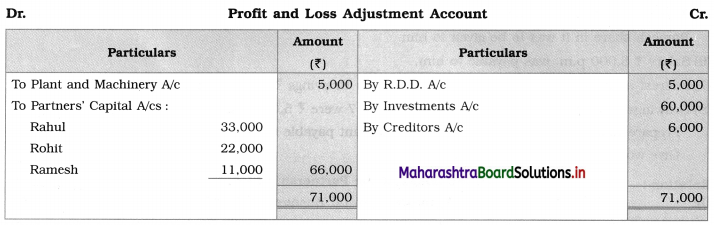

In the books of the Partnership Firm

Working Notes:

1. Calculation of share of Goodwill:

(a) Average profit = \(\frac{Total Profit}{No. of years}\)

= \(\frac{1,80,000+2,00,000+2,50,000+1,50,000+1,20,000}{5}\)

= \(\frac{9,00,000}{5}\)

= ₹ 1,80,000

(b) Goodwill = Average profit × No. of years

= 1,80.000 × 2

= ₹ 3,60,000

(c) Share of Goodwill to Ramesh = Goodwill of the firm × Ramesh’s share

= 3,60,000 × \(\frac{1}{6}\)

= ₹ 60,000

2. Calculation of share of profit due to Ramesh:

Share of profit = Last year profit × Share of profit × Period

= 1,20,000 × \(\frac{1}{6} \times \frac{6}{12}\)

= ₹ 10,000 (Profit and Loss Suspense A/c)

3. Interest on Capital is calculated for six months.

∴ Interest = 2,40,000 × \(\frac{6}{12} \times \frac{5}{100}\) = ₹ 6,000

4.

Question 3.

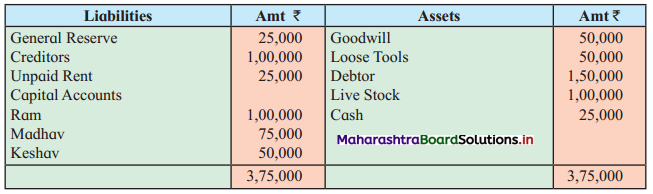

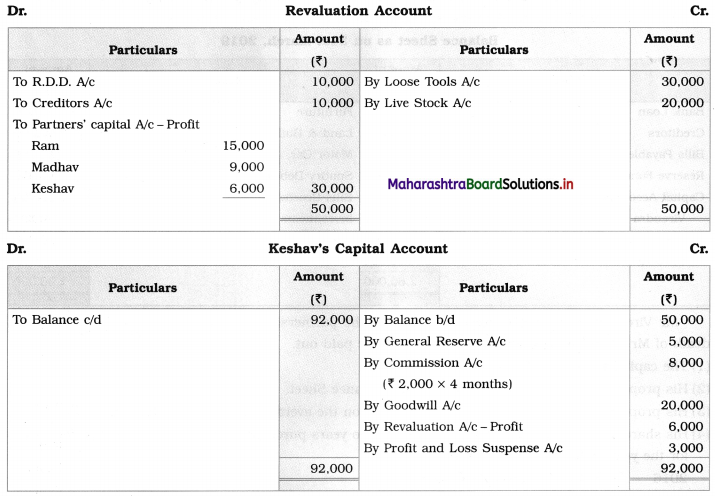

Ram, Madhav, and Keshav are partners sharing profit and losses in the ratio 5 : 3 : 2 respectively. Their Balance Sheet as of 31st March, 2018 was as follows:

Balance Sheet as of 31st March 2018

Keshav died on 31st July 2018 and the following adjustments were agreed by as per the partnership deed.

1. Creditors have increased by ₹ 10,000.

2. Goodwill is to be calculated at 2 years purchase of average profits of 5 years.

3. The profits of the preceding 5 years was

2013-14 – ₹ 90,000

2014-15 – ₹ 1,00,000

2015-16 – ₹ 60,000

2016-17 – ₹ 50,000

2017-18 – ₹ 50,000 (Loss)

Keshav’s share in it was to be given to him.

4. Loose Tools and livestock were valued at ₹ 80,000 and ₹ 1,20,000 respectively.

5. R.D.D. was maintained at ₹ 10,000.

6. Commission ₹ 2,000 p.m. was payable to Keshav. Profit for 2018-19 was estimated at ₹ 45,000 and Keshav’s share in it up to the date of his death was given to him.

Prepare Revaluation A/c, Keshav’s Capital A/c showing the amount payable to his executors.

Solution:

In the books of the Partnership Firm

Working Notes:

1. Calculation of share of Goodwill:

(a) Average profit = \(\frac{\text { Total profit }}{\text { No. of years }}\)

= \(\frac{90,000+1,00,000+60,000+50,000-50,000}{5}\)

= \(\frac{2,50,000}{5}\)

= ₹ 50,000

(b) Goodwill = Average profit × No. of years

= 50,000 × 2

= ₹ 1,00,000

(c) Share of Goodwill to Keshav = Goodwill of the firm × Keshav’s share

= 1,00,000 × \(\frac{2}{10}\)

= ₹ 20,000

2. Calculation of share of profit due to Keshav

Share of profit = Last year profit × Share of Keshav × Period

= 45,000 × \(\frac{2}{10} \times \frac{4}{12}\)

= ₹ 3,000 (Profit and Loss Suspense Account)

Question 4.

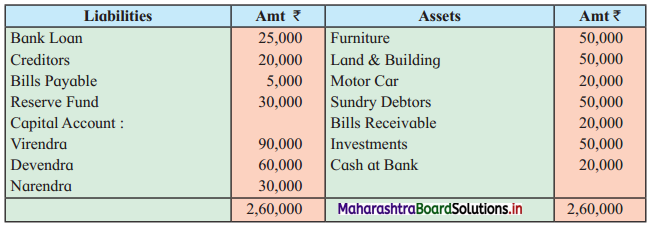

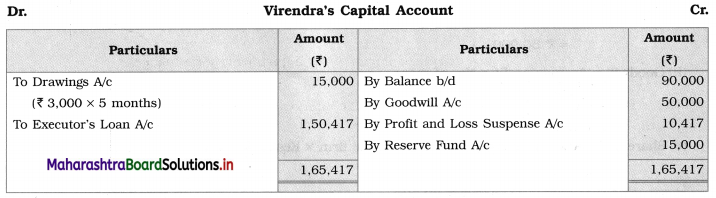

Virendra, Devendra, and Narendra were partners sharing profit and losses in the ratio of 3 : 2 : 1. Their Balance Sheet as of 31st March 2019 was as follows.

Balance Sheet as of 31st March 2019

Mr. Virendra died on 31st August 2019 and the partnership deed provided that the event of the death of Mr. Virendra his executors be entitled to be paid out.

1. The capital to his credit at the date of death.

2. His proportion of Reserve at the date of last Balance Sheet.

3. His proportion of Profits to date of death is based on the average profits of the last four years.

4. His share of Goodwill should be calculated at two years purchase of the profits of the last four years for the year ended 31st March were as follows:

2016 – ₹ 40,000

2017 – ₹ 60,000

2018 – ₹ 70,000

2019 – ₹ 30,000

5. Mr. Virendra has drawn ₹ 3,000 p.m. to date of death, There is no increase and decrease in the value of assets and liabilities.

Prepare Mr. Virendra Executors A/c.

Solution:

In the books of the Partnership Firm

Working Notes:

1. Calculation of share of profit:

(a) Average Profit = \(\frac{\text { Total profit }}{\text { No. of years }}\)

= \(\frac{40,000+60,000+70,000+30,000}{4}\)

= \(\frac{2,00,000}{4}\)

= ₹ 50,000

(b) Goodwill = Average profit × No. of years

= 50,000 × 2

= ₹ 1,00,000

(c) Share of Goodwill to Virendra = Goodwill of the firm × Virendra’s share

= 1,00,000 × \(\frac{3}{6}\)

= ₹ 50,000

2. Share of profit due to Virendra

Share of profit = Last year profit × Share of Virendra × Period

= 50,000 × \(\frac{3}{6} \times \frac{5}{12}\)

= ₹ 10,417 (Profit and Loss Suspense A/c)

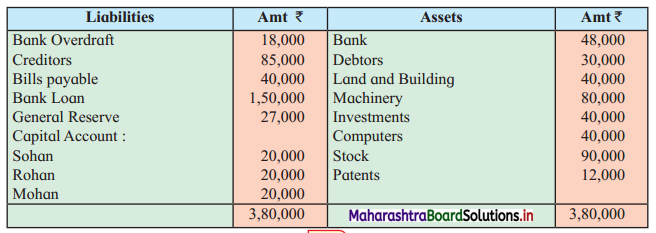

Question 5.

The Balance Sheet of Sohan, Rohan, and Mohan who were sharing profits and losses in the ratio of 3 : 2 : 1 is as follows:

Balance Sheet as of 31st March 2019

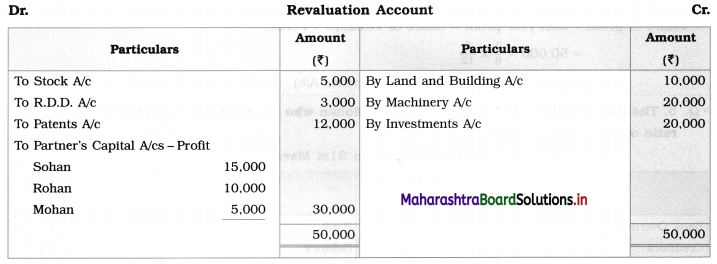

Mr. Rohan died on 1st October 2019 and the following adjustments were made:

1. Goodwill of the firm is valued at ₹ 30,000.

2. Land and Building and Machinery were found to be undervalued by 20%.

3. Investments are valued at ₹ 60,000.

4. Stock to be undervalued by ₹ 5,000 and a provision of 10% as debtors were required.

5. Patents were valueless.

6. Mr. Rohan was entitled to share in profits up to the date of death and it was decided that he may be allowed to retain his drawings as his share of profit. Rohan’s drawings till the date of death were ₹ 25,000.

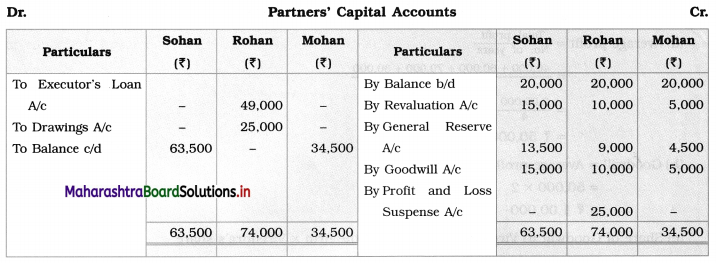

Prepare Partners’ Capital Accounts.

Solution:

In the books of the Partnership firm

Working Notes:

1.

2. Firm’s goodwill = ₹ 30,000.

DistrIbute among partners in their profit and loss ratio 3 : 2 : 1.

3. Revised value of Land & Building = \(\frac{\text { Book value }}{(100-20)} \times 100\)

= \(\frac{40,000}{80} \times 100\)

= ₹ 50,000.

∴ Increase In the value of Land & Building = Revised value – Book value

= 50,000 – 40,000

= ₹ 10,000.

4. Revised value of Machinery = \(\frac{\text { Book value }}{(100-20)} \times 100\)

= \(\frac{80,000}{80} \times 100\)

= ₹ 1 ,00,000.

∴ Increase in the value of Machinery = 1,00,000 – 80,000 = ₹ 20,000.

5. Patents were valueless means it is a loss for the business.

6. Rohan’s share In profit is ₹ 25,000 and his drawings are ₹ 25,000. Rohan is allowed to retain his drawings as his share of profit. Means write ₹ 25,000 as drawings on the debit side and write ₹ 25,000 as Profit and Loss Suspense A/c on the Credit side of Partners’ Capital A/c.